- Dial *150*01#

- Select 1 to send money.

- Select 1 to enter the receiver’s number.

- Enter the receiver’s number.

- Enter amount.

- Enter PIN to confirm sending.

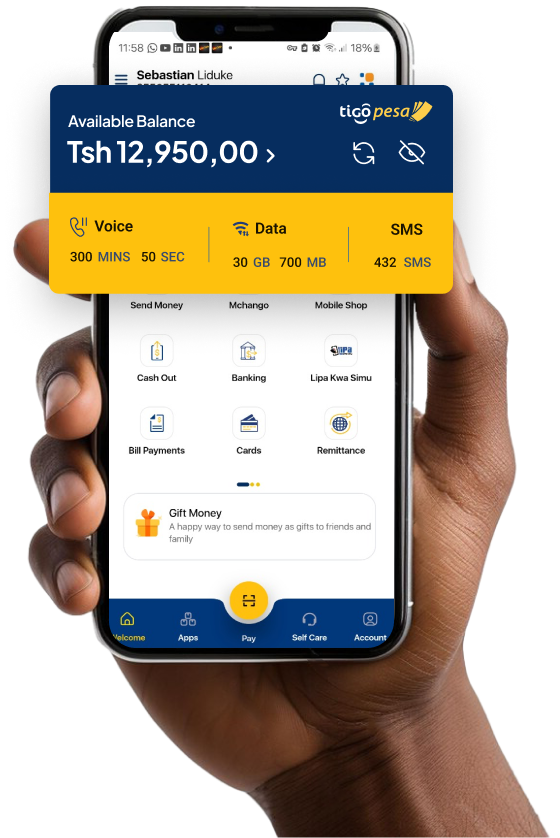

- Open the Tigo Pesa App

- Select Send Money

- You can select the contact from your phone book by tapping on choose or entering the person’s number.

- Enter the amount and tap next.

- You will see the page with the receiver’s name and enter a PIN to complete the transaction.

Lower | Upper | Cashout Fee (Without Levy) | Levy | Cashout Charges | P2P Onnet Charges | P2P IOP Charges | W2B Charges |

– | 999 | – | 10 | 10 | 15 | 15 | – |

1 000 | 1 999 | 300 | 10 | 310 | 30 | 45 | 400 |

2 000 | 2 999 | 400 | 10 | 410 | 30 | 45 | 400 |

3 000 | 3 999 | 600 | 14 | 614 | 50 | 90 | 600 |

4 000 | 4 999 | 650 | 27 | 677 | 60 | 90 | 600 |

5 000 | 6 999 | 950 | 54 | 1 004 | 130 | 180 | 800 |

7 000 | 9 999 | 1 000 | 56 | 1 056 | 150 | 180 | 1 500 |

10 000 | 14 999 | 1 450 | 102 | 1 552 | 360 | 495 | 2 000 |

15 000 | 19 999 | 1 450 | 195 | 1 645 | 360 | 495 | 2 000 |

20 000 | 29 999 | 1 850 | 306 | 2 156 | 380 | 540 | 2 000 |

30 000 | 39 999 | 1 850 | 351 | 2 201 | 400 | 612 | 2 500 |

40 000 | 49 999 | 2 350 | 419 | 2 769 | 410 | 675 | 3 000 |

50 000 | 99 999 | 2 700 | 573 | 3 273 | 720 | 1 125 | 5 000 |

100 000 | 199 999 | 3 650 | 707 | 4 357 | 1 000 | 1 440 | 6 000 |

200 000 | 299 999 | 5 300 | 821 | 6 121 | 1 200 | 1 710 | 6 500 |

300 000 | 399 999 | 6 500 | 838 | 7 338 | 1 500 | 2 070 | 6 500 |

400 000 | 499 999 | 7 000 | 982 | 7 982 | 1 500 | 2 250 | 7 000 |

500 000 | 599 999 | 7 500 | 1 245 | 8 745 | 2 200 | 2 880 | 7 500 |

600 000 | 699 999 | 8 000 | 1 532 | 9 532 | 3 300 | 3 870 | 7 500 |

700 000 | 799 999 | 8 000 | 1 700 | 9 700 | 3 300 | 3 870 | 7 500 |

800 000 | 899 999 | 8 000 | 1 750 | 9 750 | 3 500 | 3 870 | 7 500 |

900 000 | 1 000 000 | 8 000 | 1 776 | 9 776 | 3 500 | 5 400 | 8 000 |

1 000 001 | 3 000 000 | 8 000 | 1 875 | 9 875 | 5 000 | 5 400 | 8 000 |

3 000 001 | 5 000 000 | 10 000 | 2 000 | 12 000 | 5 000 | 5 400 | 8 000 |

| Tariffs and charges applicable to Tigo Pesa ATM Cash Out Services |

| From (TZS) |

To (TZS) |

Tigo S/C |

Govt Levy |

Customer ATM Charges |

|

| 10,000 |

14,999 |

1,450 |

102 |

1,552 |

| 15,000 |

19,999 |

1,450 |

195 |

1,645 |

| 20,000 |

29,999 |

1,850 |

672 |

2,522 |

| 30,000 |

39,999 |

1,850 |

770 |

2,620 |

| 40,000 |

49,999 |

2,350 |

1,050 |

3,400 |

| 50,000 |

99,999 |

2,700 |

1,435 |

4,135 |

| 100,000 |

199,999 |

3,650 |

1,771 |

5,421 |

| 200,000 |

299,999 |

5,300 |

2,058 |

7,358 |

The one-time password will expire, and your funds will be returned to your Tigo Pesa account along with the service fee.

No, all you need is your registered Tigo Pesa number and sufficient balance in your Tigo Pesa account.

Yes, your Tigo Pesa details are securely protected when using ATM withdrawal services according to Tigo Pesa service guidelines.

The 6-digit one-time password can only be used for one transaction. You will receive a new one-time password whenever you wish to withdraw money. There is no need to remember this number once it is used.

The one-time password or your Tigo Pesa PIN should not be shared with anyone else for the security of your Tigo Pesa account.

- Dial *150*01#

- Select 2 Airtime & Packages

- Select 1 Buy Airtime or 2 Packages

- Select if it’s for your number/ enter number/select contact.

- Enter amount.

- Enter PIN to confirm.

- Open the Tigo Pesa App

- Select Mobile Shop

- Choose Top Up

- Select Top up to My phone to buy for yourself or select Another Phone to buy for your family or friends.

- Enter Amount you want then Tigo Pesa PIN to confirm.

The minimum airtime purchase is TSh100, and the maximum is TSh50,000.

Customers may confirm their airtime balance by dialing *102# or *102*00# or by checking through Tigo Pesa App

Airtime Purchase transactions cannot be reversed once completed successfully. It is therefore important that you check the number carefully with your recipient or amount before you send.

A customer can make payments through a pay bill number with 6 digits xxxxxx

- Dial *150*01# ok

- Choose the No. for payment

- Enter the business number.

- Enter the amount.

- Enter the reference.

- Enter your PIN to confirm.

It is an online collection services whereby a customer’s select Tigo Pesa as a payment option in a merchant website or app, he/she will receive a pop-up message prompt to enter his Tigo Pesa PIN to complete a transaction.

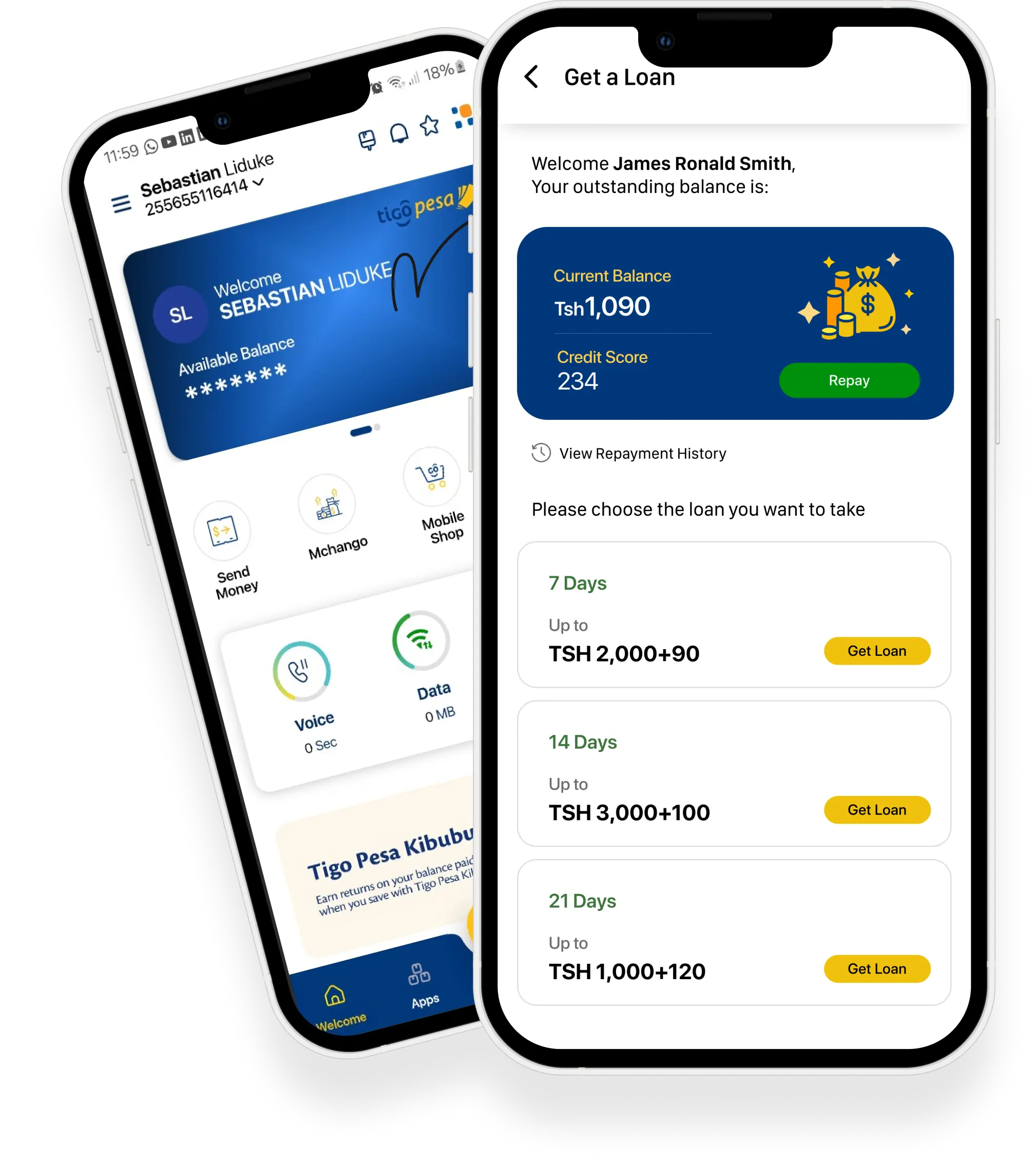

Nivushe Plus is a cash loan product that allows Tigo Pesa customers to receive short-term loans from 1,000 TSh to 2,000,000 TSh.

Tigo Pesa only offers loans to selected customers who actively use services like airtime, data, SMS, bill payments and Tigo Pesa transactions. You will get an SMS when you qualify. For those who are not qualified to get a loan, for them to qualify in the future, they will need to use more Tigo and Tigo Pesa services & transactions.

Dial *150*01# select 7 for Financial Services then select Loans then Nivushe Plus on your Tigo sim card or through Tigo Pesa App select Financial Services select Loans then select Nivushe Plus for you to Request for a loan. You will need to accept a loan Terms & Conditions before taking a loan with the specified payment period and enter the amount of money you want to take as a loan within your loan limit, and then enter your PIN to complete the transaction.

If you get a message that says you don’t qualify, you will need to use more Tigo and Tigo Pesa services & transactions.

Nivushe Plus offers loans from a minimum of Tsh 1,000. How much you can get depends on how you use your Tigo Pesa account and how you use other Tigo services like airtime, data, and SMS. Each customer is granted their own limit according to their score.

You can get loans for 7 – 90 days. The payment will be taken out of your Tigo Pesa account at the end of the term you choose.

The fee is different for each customer and each loan. Fees range between 9.2% to 25%. You will be shown how much your fee will be before you take the loan. Customers with good habits (like paying and transferring with their Tigo Pesa account and always repaying their loans on time) get lower fees.

You can take two loans at a time, but once you’ve paid your loan you can qualify for another loan immediately. Your next loan could be bigger, if you pay on time and use your Tigo Pesa account together with other Tigo services like airtime, data, and SMS.

Dial *150*01# select 7 for Financial Services, Loans, Nivushe Plus and then select 3 for “Outstanding Loan balance” or through Tigo Pesa App select Loans select Nivushe Plus then select “Outstanding Loan balance”

To repay your Nivushe Plus make sure you have enough money in your Tigo Pesa account on the day your loan is due and Nivushe Plus will initiate an auto strike from your Tigo Pesa wallet. If you prefer to pay early or late, dial *150*01# and select 7 for Financial Services select Loans then Nivushe Plus then 2 for “Repay Loan” or you can use Tigo Pesa App select Loans then Nivushe Plus then select “Repay Loan“. You can then choose whether you want to pay the whole loan, or only part of the loan and enter your PIN to confirm.

If you do not pay your loan on the due date you will have to pay a penalty fee of up to 7%- 10% of the outstanding balance. You will get an SMS to remind you to pay before the due date. If you pay late your next loan may be smaller, and if you often pay your loans late you could be removed from the Nivushe Plus service.

Use Tigo and Tigo Pesa services & transactions more often, and make sure you repay your loans on time. The loan amounts you get are decided by your use of Tigo services like airtime, data, SMS, bill payments and Tigo Pesa transactions and by looking at whether you repay your loans on time, every time.

If you’ve paid one of your loans late, or if you’re using Tigo Pesa or other Tigo services less than you used to. The loan amounts you get are decided by your use of Tigo services like airtime, data, SMS, bill payments and Tigo Pesa transactions and by looking at whether you repay your loans on time, every time.

If the message notification you get is that you don’t qualify this means that you need to use Tigo and Tigo Pesa services regularly to be qualified in the future and pay the loan on time.

If the message notification is “You have reached your daily loan limit”. Please try after 24 hours for you to enjoy the Nivushe Plus service.

Nivushe Plus is a better version of Tigo Nivushe, they are both managed by Tigo. The main difference is financial service providers i.e with Nivushe, Absa and Jumo were the only providers- while with Nivushe Plus we will have more than one FSP’s which are Azania Bank, Letshego Bank, CRDB Bank and Jumo, therefore we will be able to serve more customers.

This service allows our customers to reverse a wrong transaction sent to another Tigo Pesa number, to another operator number, cashed out wrongly to Wakala, and a wrong bank account.

Also, a Tigo Pesa agent can reverse a Cashin transaction sent wrongly to a customer.

This service allows our Tigo Pesa customer to obtain their LUKU/TUKUZA Token in case they have not received their LUKU/TUKUZA token through SMS or deleted LUKU/TUKUZA token SMS by accident.

Within 12 hours from the time you have performed the wrong transaction.

No, You will be charged 50 Tshs for now.